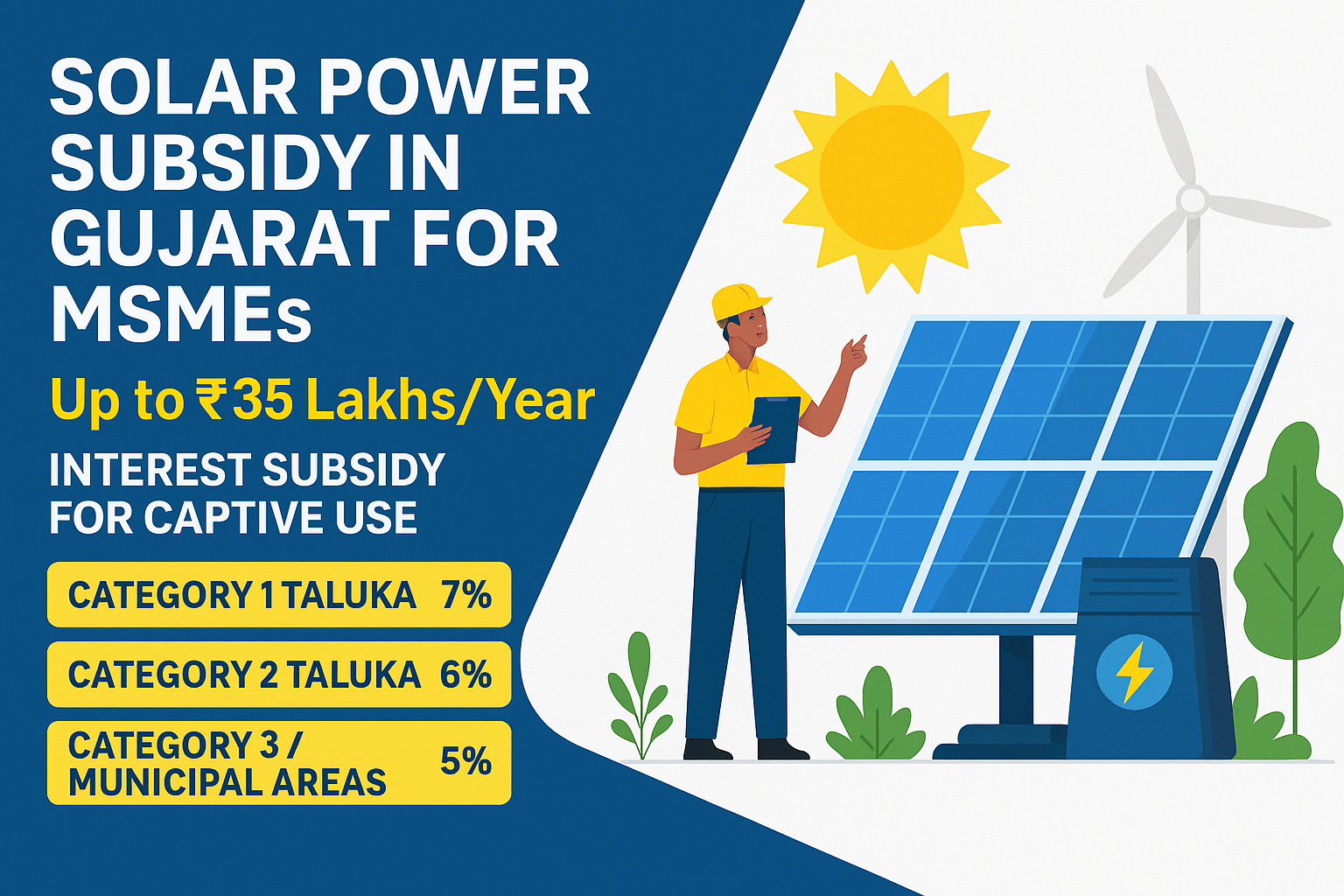

Interest Subsidy for Solar and Renewable Power Plants (Captive Use) to MSMEs in Gujarat

🌱 Go Green, Save Costs, Grow Faster!

Under the visionary Aatmanirbhar Gujarat Scheme for Assistance to MSMEs, the Government of Gujarat is supporting MSMEs that invest in Solar, Wind, Hydro, Hybrid, or other renewable energy plants for captive use.

By switching to renewable energy, MSMEs can lower their power costs significantly—and now, they can also benefit from a generous interest subsidy on their term loans for such installations.

✅ Who is Eligible?

Only manufacturing MSMEs registered in Gujarat (Micro, Small, or Medium Enterprises).

The unit must set up a new solar or renewable power plant for captive use within its own premises (or elsewhere in Gujarat).

This subsidy is available only once for renewable energy installation.

Units that have already availed this subsidy under an earlier scheme are not eligible again.

Service sector units are not eligible under this subsidy.

⚡ What Type of Power Plants Are Covered?

Solar Power Subsidy for Gujarat MSMEs

Eligible renewable energy sources include:

✅ Solar

✅ Wind

✅ Hydro

✅ Hybrid

✅ Other renewable energy technologies (approved by authorities)

These installations can be:

Rooftop solar systems, or

Ground-mounted plants

Captive desalination or renewable power generation plants for in-house use

💰 Subsidy Rates Based on Taluka Category

The interest subsidy is linked to the location of the manufacturing unit, not where the renewable plant is set up:

| Taluka Category | Interest Subsidy | Max Amount (per annum) | Duration |

|---|---|---|---|

| Category 1 Taluka | 7% | ₹35.00 Lakhs | 7 Years |

| Category 2 Taluka | 6% | ₹30.00 Lakhs | 6 Years |

| Category 3 & Municipal Areas | 5% | ₹25.00 Lakhs | 5 Years |

📌 Final classification of Talukas is determined by the Government.

🎁 Additional 1% Interest Subsidy (If You Qualify)

An additional 1% interest subsidy is available in the following cases:

| Category | Conditions |

|---|---|

| Women Entrepreneur | 100% ownership by women |

| Differently Abled | 100% ownership by differently abled entrepreneurs |

| Registered Startup | Recognized by DPIIT (GoI) or Govt. of Gujarat in the manufacturing sector |

| Young Entrepreneur | Age below 35 years at the time of term loan sanction, with 100% ownership |

📌 Valid age proof required: School Leaving Certificate or Birth Certificate.

📝 Important Notes

Minimum 2% interest must always be borne by the MSME, even after accounting for Central and State subsidies.

If interest subsidy is also received from Government of India, the state subsidy will be limited so that the enterprise pays at least 2% net interest.

If the enterprise defaults (RBI: 90+ days overdue), the default period will be deducted from eligible subsidy duration.

Loan takeovers between banks will be handled based on actual principal outstanding or newly released term loan—whichever is lower.

🔄 Expansion + Solar Project? You Get Both!

If an existing MSME goes for expansion and installs a renewable power plant, it can claim interest subsidy for both, separately.

📌 Example:

If your unit is in Category 3 Taluka, you will get:

5% interest subsidy for expansion

5% interest subsidy for renewable power plant installation

(As per the taluka category of the manufacturing unit.)

📑 Conditions for Claim

Valid insurance of machinery/building/shed is mandatory.

Maintain separate bank records or certificates if term loan is used for multiple projects.

Captive power plants must be used only by the same unit.

The subsidy is valid only for new installations of renewable plants.

🏁 Conclusion

With rising electricity costs and increasing pressure for sustainability, installing a captive renewable power plant is a smart business move. Gujarat’s Interest Subsidy Scheme for MSMEs makes this move even smarter—by reducing the burden of interest on term loans.

Whether you’re a young entrepreneur, a startup, or a seasoned MSME, this is your chance to go green and grow lean.

📞 Need Help?

For assistance with: Book Consultation

Project report preparation

Loan structuring

Application and claim submission

Government Subsidy

👉 Contact Adroit Corporation

📧 Email: sales@adroitcorporation.in

📞 Call: +91 7203010101 | +91 8734010101