Subsidy for Manufacturing Unit in Maharashtra – Complete Guide (PSI-2019)

Subsidy for Manufacturing Unit in Maharashtra – Complete Guide (PSI-2019)

Updated as per Maharashtra Package Scheme of Incentives 2019 (Valid until new scheme is announced)

Maharashtra is India’s second-largest industrial hub and one of the most supportive states for manufacturing enterprises. With the Package Scheme of Incentives (PSI-2019), the Government of Maharashtra provides substantial subsidies to promote new manufacturing units in less-developed regions and priority sectors.

Whether you want to start a factory in Pune, Nashik, Aurangabad, Nagpur, Raigad, Kolhapur, or Vidarbha, understanding the PSI-2019 policy will help you optimize your project cost and maximize financial benefits.

This blog provides a simple, complete and updated guide to all incentives available for manufacturing units under PSI-2019.

✅ 1. What Is PSI-2019?

The Package Scheme of Incentives 2019 (PSI-2019) is Maharashtra’s industrial subsidy policy that offers:

Industrial Promotion Subsidy (IPS)

Interest Subsidy

Electricity Duty Exemption

Power Tariff Subsidy

Stamp Duty Exemption

Additional incentives for MSMEs

The benefits differ based on taluka classification, sector, and project size (MSME / LSI / Mega).

✅ 2. Who Is Eligible for Subsidy?

You are eligible if you set up a new manufacturing unit in Maharashtra that falls under:

✔ Industries listed in First Schedule of IDRA Act

✔ MSME manufacturing units

✔ Food & agro processing (secondary & tertiary)

✔ IT/Electronics hardware

✔ Biofuel, green energy

✔ Logistics, warehousing

✔ Industry 4.0 / EV / advanced manufacturing

❌ Not eligible: liquor, tobacco, gutkha, banned products.

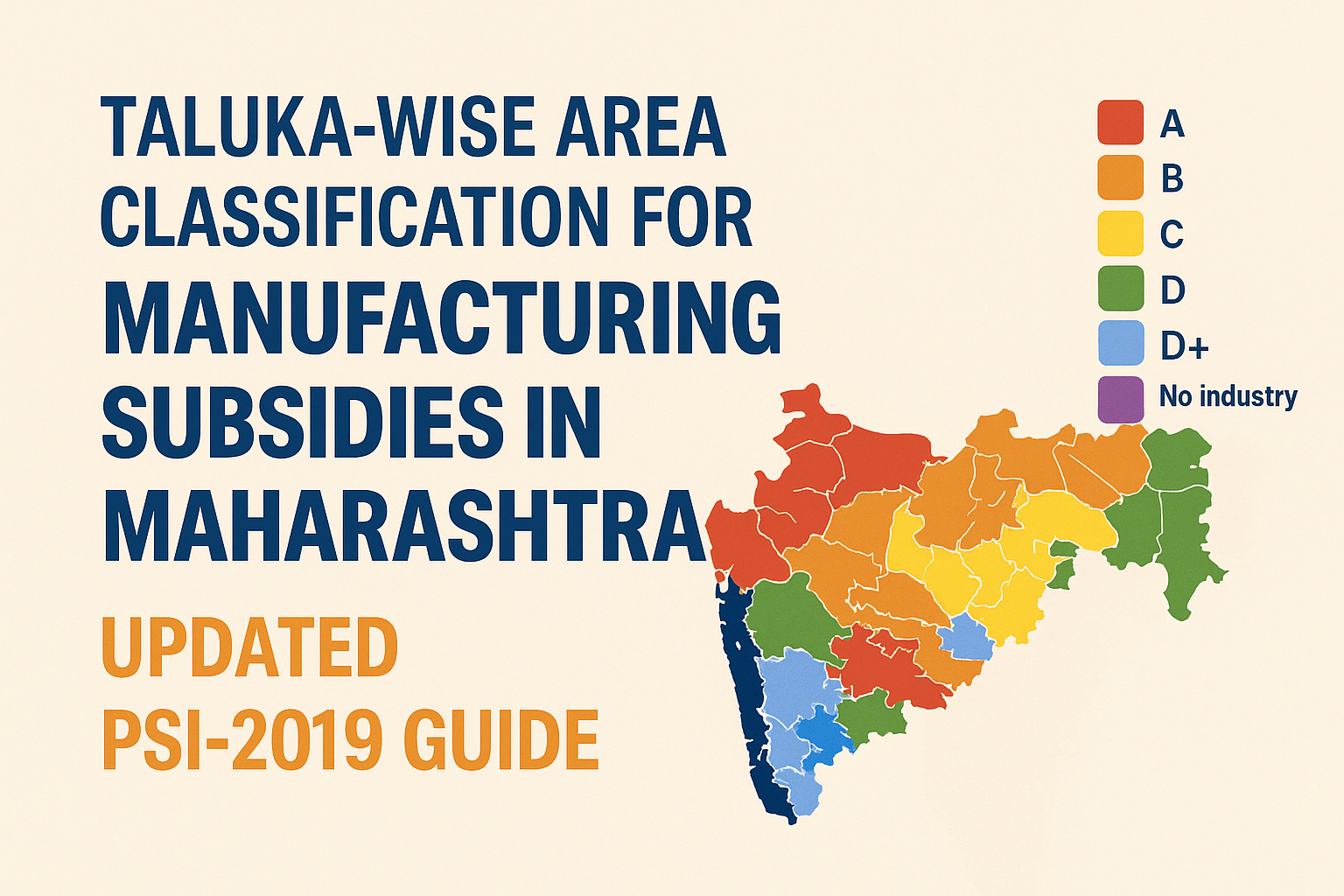

✅ 3. Area Classification – The Most Important Factor

Subsidy differs taluka-wise. Maharashtra is classified into:

| Area Type | Subsidy Level |

|---|---|

| Group A | Low |

| Group B | Low |

| Group C | Moderate |

| Group D | High |

| Group D+ | Very High |

| No Industry Districts | Maximum |

| Naxal Affected Areas | Maximum |

| Aspirational Districts | Maximum |

More backward area = higher subsidy.

Some districts like Vidarbha, Marathwada, Ratnagiri, Sindhudurg, Dhule get special 80% basket benefit.

✅ 4. Subsidy Benefits for MSME Manufacturing Units

4.1 Industrial Promotion Subsidy (IPS)

MSMEs get 100% SGST refund on first sale within Maharashtra during the eligibility period.

4.2 Interest Subsidy

Up to 5% interest subsidy on term loan (subject to electricity bill amount).

4.3 Stamp Duty Exemption

Available in C, D, D+, No Industry, Aspirational & Naxal areas.

4.4 Electricity Duty Exemption

7–10 years (depending on area).

4.5 Power Tariff Subsidy

₹1/unit for Vidarbha, Marathwada, Ratnagiri, Sindhudurg, Dhule

₹0.50/unit for other areas

for 3 years.

✅ 5. How Much Subsidy Will You Get? (Area-wise Breakdown)

🟩 Group C Areas – 30% of FCI

Eligibility period: 7 years

🟦 Group D Areas – 40% of FCI

Eligibility period: 10 years

🟨 Group D+ Areas – 50% of FCI

Eligibility period: 10 years

🟧 Special Districts (Vidarbha, Marathwada, Ratnagiri, Sindhudurg & Dhule)

Subsidy up to 80% of FCI

🟥 No-Industry Districts / Naxal / Aspirational

Subsidy up to 100% of FCI

✅ 6. Additional 20% Extra Subsidy for Priority Sectors

These units get 20% more subsidy + 2 extra years eligibility:

Food processing (Secondary & Tertiary)

Farmer Producer Companies (Primary also allowed)

Green energy / biofuel units

Industry 4.0 manufacturing

Renewable energy component units

❗ Maximum total subsidy = 100% of eligible FCI

✅ 7. Subsidy for Large, Mega & Ultra-Mega Manufacturing Units

LSI (Large Scale Industries)

IPS = 50% of SGST

Basket subsidy:

C area – 40%

D area – 60%

D+ area – 70%

Special district – 80%

Naxal / Aspirational – 100%

Mega / Ultra-Mega Projects

Benefits decided by High Power Committee (HPC)

— often extremely high, including:

100% SGST refund

Capital subsidy

Stamp duty exemption

Electricity duty exemption

Customized incentives

✅ 8. What Counts as Eligible Fixed Capital Investment (FCI)?

You get subsidy on:

✔ Land

✔ Building

✔ Factory shed

✔ Plant & Machinery

✔ Utilities (electricals, DG, transformer)

✔ Installation, testing

✔ R&D

✔ Pre-operative expenses (upto 10%)

❌ NOT eligible:

Vehicles, furniture, deposits, second-hand machinery older than 10 years, residential buildings.

✅ 9. Key Conditions for Claiming Subsidy

Complete effective steps

Apply before commercial production

Start commercial production within investment period

Maintain employment norms

Maintain production & sales records

Annual audited financials

Submit IPS, interest subsidy & other claims on time

✅ 10. How to Apply for PSI-2019 Subsidy? (Step-by-Step)

Step 1: Acquire land / lease (effective possession)

Step 2: Get statutory approvals (MPCB, IEM/Udyam)

Step 3: Apply for Eligibility Certificate (EC)

Step 4: Start commercial production

Step 5: Submit documents to get EC issued

Step 6: Claim IPS / interest subsidy every year

Step 7: Comply with monitoring & operative period

🔥 11. Real Advantage – Why Maharashtra Is Best for Manufacturers?

High subsidy in backward areas

Special support for MSMEs

High ease of doing business

Strong industrial infrastructure (MIDC)

Supportive banking ecosystem

Talent availability

Proximity to Mumbai–Pune trade belt

🎯 Conclusion

Setting up a manufacturing unit in Maharashtra under PSI-2019 can significantly reduce your project cost, loan repayment burden, and operational expenses.

With correct planning, many units can recover 40% to 100% of their project cost through subsidies.

If you are planning a new unit or an expansion, choosing the right taluka and right project structure can help you maximize subsidy.

📞 Need Professional Assistance to Calculate Your Subsidy?

Adroit Corporation specializes in:

✔ PSI-2019 subsidy planning

✔ Project report preparation

✔ Loan & subsidy application support

✔ Area-wise subsidy calculation

✔ End-to-end execution until disbursement

Contact:

📧 sales@adroitcorporation.in

📞 7203010101

🌐 www.adroitcorporation.in